Using CPF’s Ordinary Account (OA) to service our mortgage loans may well be the norm and straight-forward decision for most, including myself. It almost seems like the default option that most home owners prefers compared to using cash. Note that regardless of taking a bank loan or HDB loan, you can choose to pay via CPF OA, cash or a combination of both.

Popular Option: CPF OA

It is easy to appreciate why using CPF OA is preferred by many. OA is almost illiquid and there are only few cases (e.g education, housing etc) where OA monies can be tapped on. Hence, most would like to make use of this concession to service our mortgage loan, which would otherwise be ‘locked up’ in CPF until we are at least 55.

The alternative option of using cash for mortgage loan is not usually preferred because it will reduce our monthly dispensable income or cashflow, which may be a few hundreds to thousands, and directly impact our livelihood and lifestyle. By diverting our mortgage instalments to OA, we will have a higher disposable income. Afterall, holding cash on hand is better than having them in CPF (at least some believe so).

Why I switched to cash?

Just because we are allowed to use CPF OA for mortgage loans, doesn’t mean that we have to. There is an opportunity cost of forgoing the 2.5% interest when we use our OA for mortgage payment. In essence, this refers to CPF’s accrued interest, which is the amount of interest you would have earned in OA if it has not been used for mortgage payment. You can check the accrued interest from your CPF account if you have been using OA for mortgage loan.

This 2.5% interest is attainable at almost zero risk (as 2.5% OA interest is mandated by law) and there is no financial instrument that can provide 2.5% interest without risk. It is too good a deal to be missed and almost akin to ‘free’ money.

Does accrued interest actually matter?If you are not selling your house, it has no material impact except the fact that you missed out on the 2.5% interest which you would have earned from CPF. However, if you intend to sell your house, note that the total amount used from OA plus accrued interest will be deducted from the proceeds received after the sale of your flat. This amount will be ‘returned’ back to your CPF OA. Essentially, you are borrowing money from your OA account and returning back to your CPF account with interest. End of the day, it is still your funds. |

Use CPF or Cash depending on your situation

The timing of making the switch to cash is most important in my opinion. When I was younger, cashflow was tight as there were many big-ticket items such as renovation, weddings etc to plan for. Hence, using CPF OA to start financing my mortgage loan was a no brainer. My priority then was to save for these impending expenses.

After a few years, having settled most of these big-ticket items and coupled with an increased income, my cashflow was in a better position which allowed me to switch financing mode to cash. Essentially, my priorities and circumstances have changed and I’m now focused on building my OA (after achieving FRS in SA).

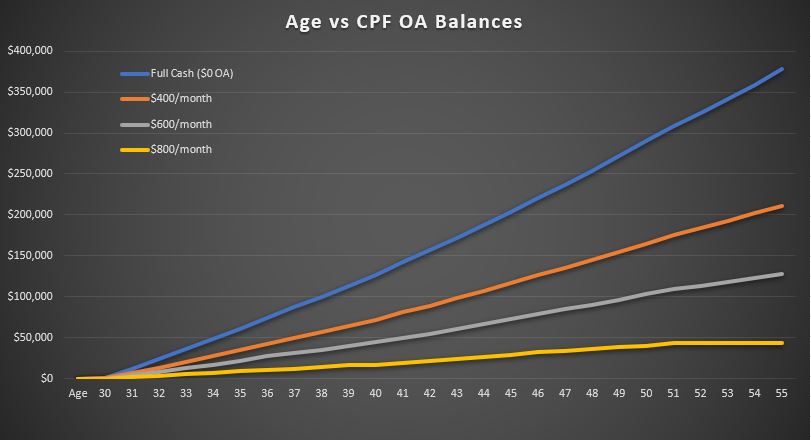

Below illustration shows the simulations between using cash and OA ($400,$600,$800/month) for mortgage payment over a 25 year loan period. It is evident how fast OA can compound if it is not used for mortgage payment.

Another reason that I was able to manage my cashflow and pay with cash is because I managed to lower my mortgage loan by switching to bank loan (stay tuned for more on this).

The beauty of switching to financing mortgage via cash is that it allows my OA to grow and compound. At the same time, the option to switch back to CPF payment still remains available and serves as a contingency plan should there be any unforeseen cashflow issues.

Closing

Using cash to service mortgage payments will allow your OA to accumulate faster to achieve your retirement goal. However, there is no right or wrong in choosing whether to use CPF and/or Cash for mortgage payments because it dependent on everyone’s unique situation/ circumstance. Yet, I would encourage you to be open-minded and flexible to review and switch between CPF and/or Cash at different phases of your life depending on your cashflow situation. You may be surprised how doing so could make a difference in your plans.